Transforming Client Convictions into Actionable Metrics for Portfolio Optimization

Translating subjective client preferences into objective investment decisions represents a fundamental challenge in modern investment management. The SeekInvest Values Alignment Score addresses this challenge through a sophisticated, data-driven framework that converts complex company behaviors into clear, actionable metrics for portfolio optimization.

Traditional approaches rely on oversimplified categorizations that fail to capture the nuanced complexity of investor values. Terms like “socially responsible” and “environmentally conscious” introduce ambiguity in the advisor-client relationship due to:

- Lack of standardization, preventing meaningful comparison.

- Binary labels that oversimplify the complexity of corporate behavior.

- Surface-level categorization which obscures the magnitude of real impact.

- Rigid frameworks that cannot adapt to different investor value hierarchies.

Most importantly, these approaches fail to capture the multifaceted nature of personal client preferences. An investor deeply committed to community welfare but indifferent to corporate governance requires a different evaluation framework than one prioritizing labor practices above environmental concerns.

The Values Alignment Score transcends these limitations by quantifying specific corporate activities and outcomes according to individual priorities. This transforms abstract preferences into concrete investment criteria, enabling portfolio construction that honors both financial objectives and personal convictions.

A precise framework for analyzing and communicating alignment

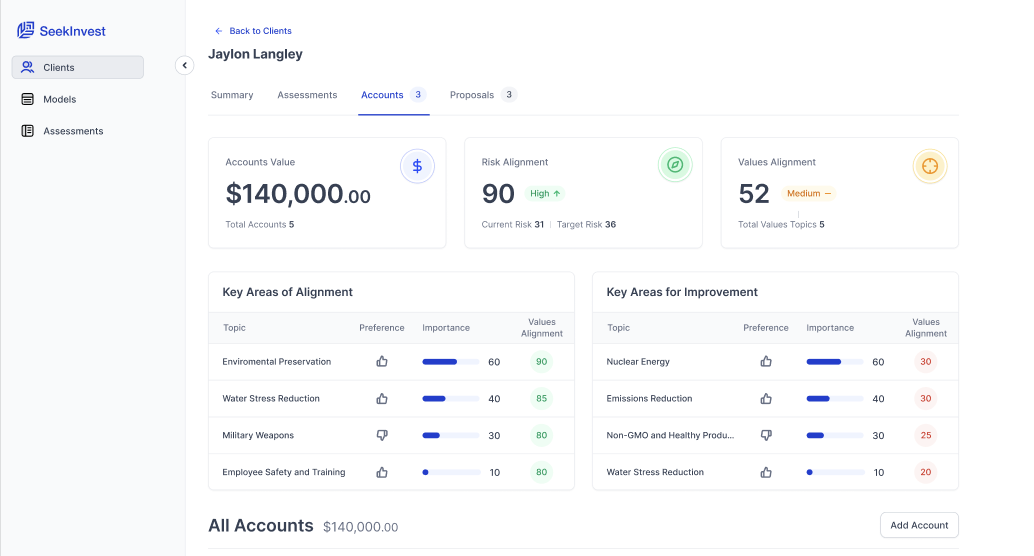

The Values Alignment Score provides an analytical framework designed to represent values alignment across multiple investment dimensions. The score ranges from 0 to 100, providing precise measurement at three critical levels of investment management.

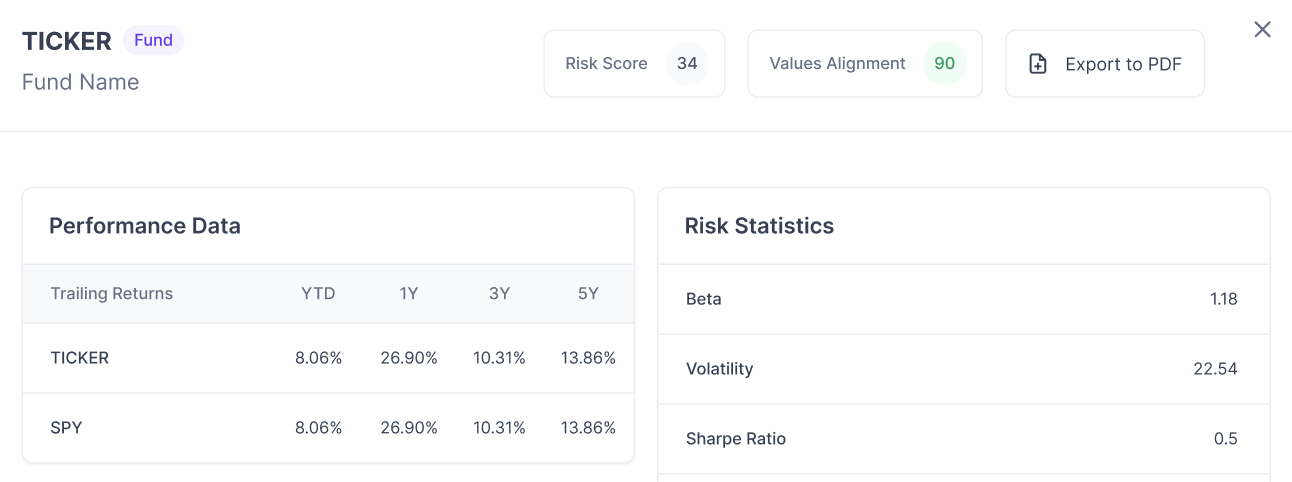

At its most granular level, the score evaluates individual securities, measuring how closely a specific company’s practices or fund’s holdings align with client values. This security-level analysis forms the foundation for broader portfolio construction and management decisions.

Account-level scoring reflects how specific investment strategies and account purposes align with client values while operating within their defined objectives.

At its broadest application, the score provides a comprehensive evaluation of the entire portfolio, aggregating account-level measurements to deliver a holistic view of values alignment across the client’s complete investment strategy.

Powering the journey to client success

Advisors know the importance of meaningful client conversations, but struggle to translate these discussions into clearly articulated investment decisions backed by compelling data.

SeekInvest helps advisors bridge this gap by providing compelling portfolio analysis and proposal generation to showcase how investment decisions improve values alignment:

- The journey begins with meaningful conversations and analysis of the client’s current portfolio, using metrics and visuals that act like a GPS for better alignment.

- Comprehensive proposals drive the path forward with confidence. Rather than overwhelming with complex statistics, the Values Alignment Score provides a clear metric to show exactly how the portfolio can move from an alignment of 64 to 87, backed by rich data on performance and impact.

- The path from 64 to 87 comes alive through continuous insights, demonstrating how each investment decision strengthens alignment, and in turn strengthens the client’s trust and loyalty.

With a precise framework for values alignment guiding the course, advisors navigate confidently between meaningful dialogue and portfolio enhancements. Each improvement in alignment scores reflects purposeful progress toward truly aligned investing and lasting client relationships.