What is Climate Litigation?

Climate litigation uses environmental laws to establish precedent to compel climate change mitigation efforts. Litigation can be directed at public and private companies, federal governments, city administrations and insurance companies.

Climate litigants uses one of five approaches to argue cases:

- constitutional law – a state’s breaching of constitutional rights

- administrative law – challenging decision-making within existing laws

- private law – confronting corporations or other organizations for negligence, nuisance, and unjust enrichment (see the case against Shell)

- fraud or consumer protection – holding companies, states or other organizations accountable for misinformation

- human rights – demonstrate that not acting on climate change or protecting natural resources, such as the atmosphere or the rainforest, fails to protect human rights

As more companies make net-zero commitments, we will likely see more cases on greenwashing and misrepresentation, as well as adhering to due diligence rules. Litigation in these areas is likely to focus on personal responsibility, ranging from criminal actions to dereliction of directors, officers or trustees’ duties in managing climate risks. Litigation can also focus compensation for losses and damage due to climate change. Impactful litigation should empower communities and stakeholders to affect change.

How Climate Litigation may impact the investment industry

The investment industry has extensively debated the role of environmental, social and governance (ESG) factors in investing. Specifically, the industry questions whether to use these factors in taking investment decisions from a risk or valuation perspective. Many of the largest and most sophisticated institutional investors have established clear ESG and sustainability principles (see CalPERs approach) to guide their decisions.

Climate litigation, however, is not widely discussed nor is such activity on the radar screen for many investors. Notably, environmental litigation is growing and beginning to impact the systems that drive climate change.

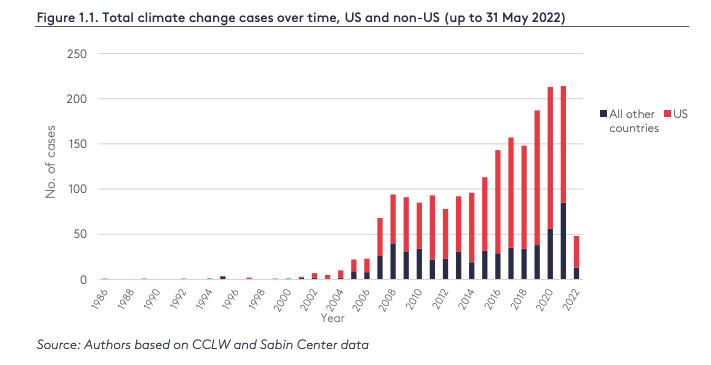

According to a recent report by the London School of Economics “… the cumulative number of climate change-related cases has more than doubled since 2015, bringing the total number of cases to over 2,000. Around one-quarter of these were filed between 2020 and 2022.” The Sabine Center for Climate Change Law’s U.S. and Global Climate Change Litigation databases currently have 1,497 and 623 cases respectively across over 40 countries.

Climate Litigation – A Potential Powerful Impact on Investments

For investors, their advisors and investment managers, climate litigation will lead to greater disclosures and transparency. Consequently, the need for understanding context and the ability to translate data into analysis will increase. Advisors and investment managers will need to consider climate litigation risk when assessing climate-related financial risks and integrate these risks into investment growth modeling. Simply understanding a carbon footprint will not be nearly enough to assess whether a company has acted consistently with commitments and targets or if their products and actions are managed in line with their disclosures and stated goals. As ExxonMobil and Shell are finding out, ignoring climate change and failure to transition to a cleaner business model can become litigious and expensive.